Renters Insurance in and around Los Angeles

Los Angeles renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

There's a lot to think about when it comes to renting a home - outdoor living space, location, furnishings, apartment or condo? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Los Angeles renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Protect Your Home Sweet Rental Home

When the unexpected burglary happens to your rented space or property, generally it affects your personal belongings, such as a desk, a coffee maker or a set of golf clubs. That's where your renters insurance comes in. State Farm agent Angelica Campos can help you evaluate your risks so that you can protect your belongings.

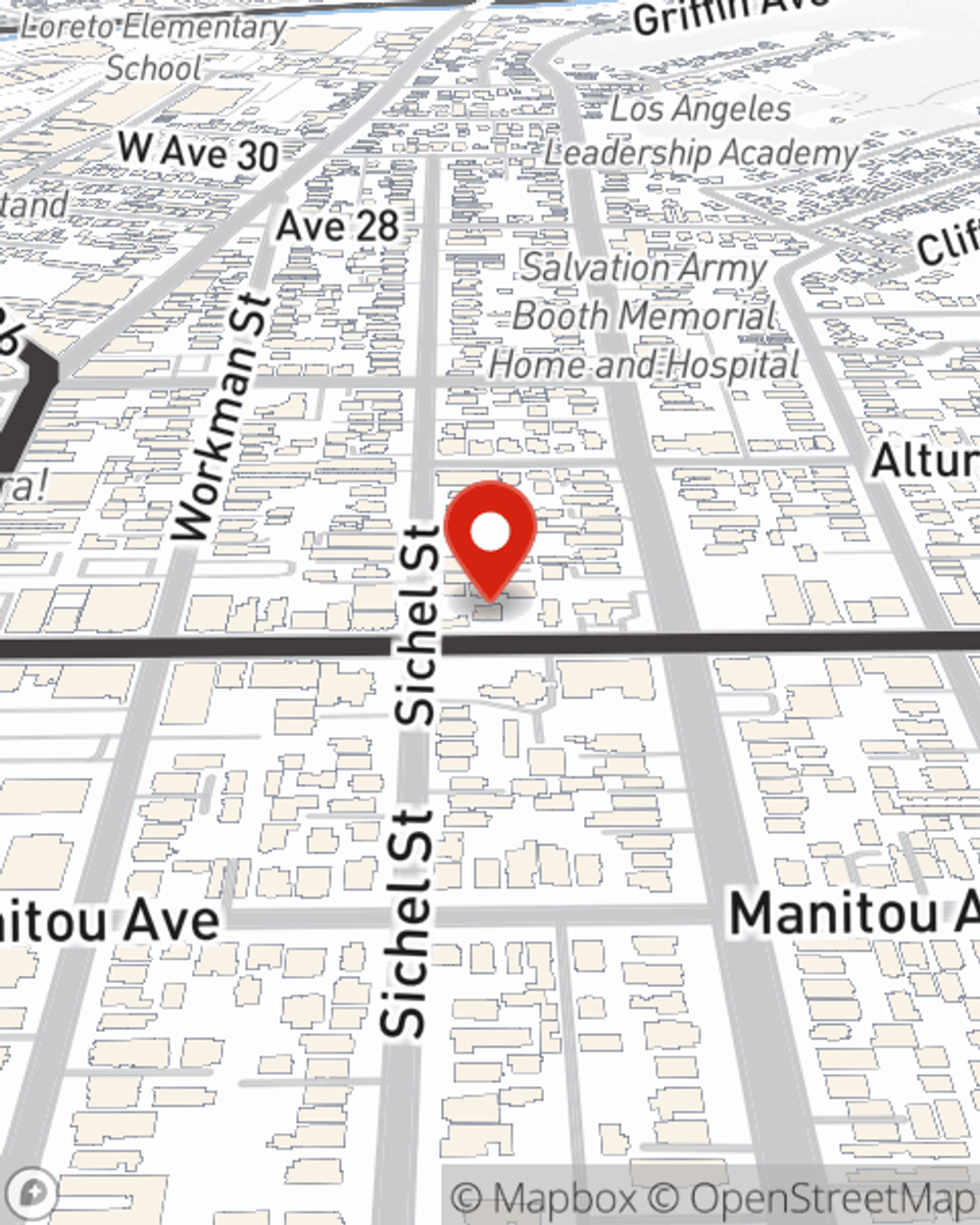

Reach out to State Farm Agent Angelica Campos today to explore how the leading provider of renters insurance can protect items in your home here in Los Angeles, CA.

Have More Questions About Renters Insurance?

Call Angelica at (323) 222-9966 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Angelica Campos

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.