Business Insurance in and around Los Angeles

Looking for small business insurance coverage?

This small business insurance is not risky

Insure The Business You've Built.

You may be feeling like there is so much to do with running your small business and that you have to handle it all on your own. State Farm agent Angelica Campos, a fellow business owner, understands the responsibility on your shoulders and is here to help you get started on a policy that's right for your needs.

Looking for small business insurance coverage?

This small business insurance is not risky

Insurance Designed For Small Business

For your small business, whether it's a pizza parlor, a bakery, a bridal shop, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like loss of income, business liability, and business property.

It's time to visit State Farm agent Angelica Campos. You'll quickly uncover why State Farm is one of the leading providers of small business insurance.

Simple Insights®

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

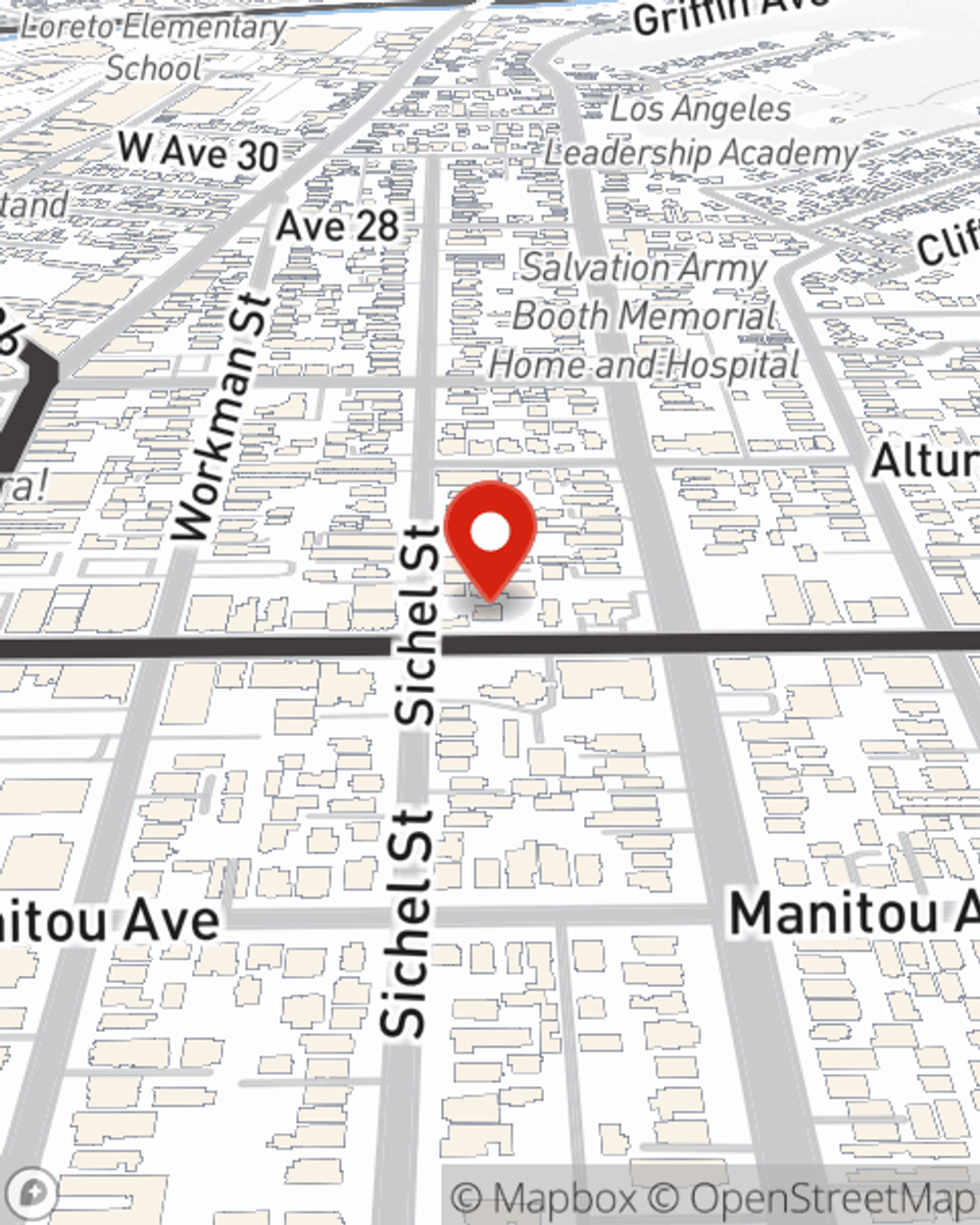

Angelica Campos

State Farm® Insurance AgentSimple Insights®

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.